Helm Bank USA

Escrow Guide

How To Understand Your

Annual Escrow Account Disclosure Statement

An escrow account is a special account maintained by Helm Bank USA as part of your mortgage. A portion of each mortgage payment is deposited into this account to cover recurring property-related expenses, such as real estate taxes, homeowner’s insurance, and flood insurance, ensuring timely payments on your behalf.

Breakdown of the Disclosure

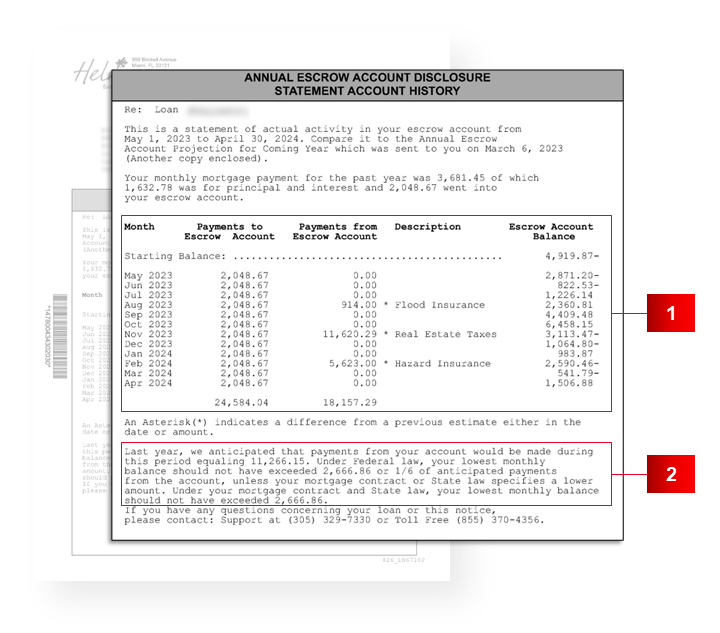

1. Statement of Escrow Account History

This section of your Annual Escrow Account Disclosure explains the actual activity from the prior period.

2. Required Minimum Balance

This section explains the minimum balance anticipated in your escrow account.

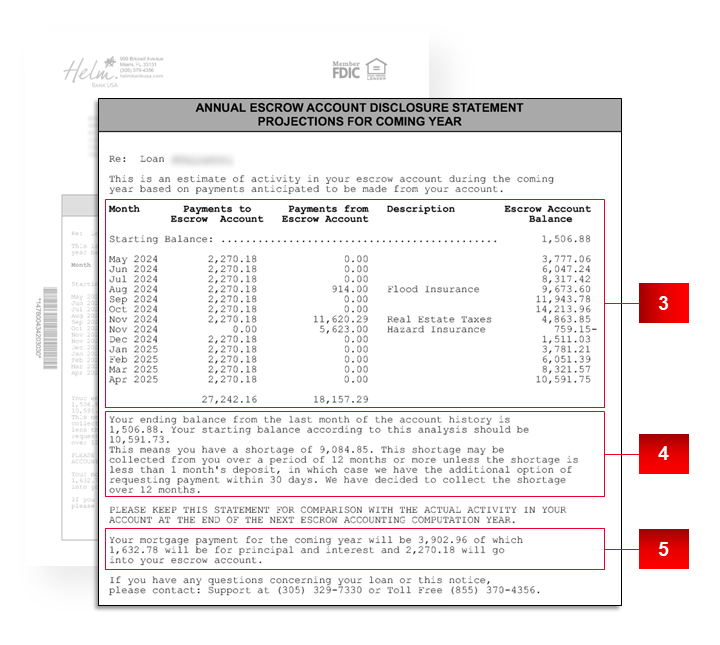

3. Projected Escrow Payments for the Coming Year

This section of your Annual Escrow Account Disclosure explains the projected activity for the coming year.

4. Deficiency, Shortage and Surplus Explanation

This section explains the deficiency, shortage and surplus in your account based on the current escrow balance and your projected new balance.

The surplus, shortage or deficiency amounts are typically due to changes in real estate taxes and insurance premiums. Increases in the payment amounts are typically a result of higher taxes or insurance payments.

Deficiency: An escrow account requires at least 2 months worth of payment as a cushion. If you have a deficiency, that means that you do not have enough money in your escrow account to cover the required starting balance.

Shortage: The repayment of any shortage amount is automatically spread over the next 12 monthly mortgage payments. You also have the option to pay the shortage in full.

Surplus: If you have a surplus of $50.00 or less, it will remain in your escrow account. A surplus of more than $50.00 will be refunded to you.

5. New Monthly Mortgage Payment

This is a breakdown of your new monthly payment amount.

1. What options do you have if your escrow statements shows a shortage/ deficiency?

You have two options:

A. Pay entire shortage / deficiency now*; or

B. Pay your shortage / deficiency over the next 12 months as part of your new monthly mortgage payment amount.

2. If you choose to pay your entire shortage in full, where do you send it?

You have two options:

Attn: Loan Servicing Department

999 Brickell Avenue

Miami, Florida 33131

SWIFT / ABA Routing Number: HELMUS33 / 067011456

Beneficiary Address: 999 Brickell Avenue Miami, FL 33131

Beneficiary Name: Loan Servicing Department

OBI: Escrow Shortage Payment

3. Will your payment amount remain the same if you pay your shortage in full?

No, however, paying your shortage in full will minimize your new escrow payment amount.

4. What happens if your statement shows a surplus?

We provide you with three options to receive your refund, as follows:

A. You can choose to receive your escrow overage refund by check.

B. You can choose to apply your escrow overage refund amount to your outstanding principal balance.

C. You can choose to apply your escrow overage refund amount to your escrow account.

Note: If your loan is more than 30 days delinquent, Helm Bank USA may hold the surplus amount in your escrow account.